I mean, there is so much new technology there’s got to be a better way to do a lot of things, right? And then when it comes to parenting, there are new whiz-bang ideas everywhere you look.

My parents had a money system for us growing up. It is outlined in detail in this book

(and a few of their other books).

I remember pretty vividly the day my Dad introduced the new “system.” He sat us down on our big brown patchwork sectional (the vintage one I wish I had a picture of) and showed us a video he had made… of himself explaining our new money system.

{post-edit note…I found this video and posted it HERE…it is awesome}

{post-edit note…I found this video and posted it HERE…it is awesome}

I think I need to try that method of getting children to listen if I can still remember it all these years later…

Anyway, the system worked (at least, the refined simplified version that came AFTER that complicated video, worked!). It was a little complex, but boy did I want to earn money. I had to pay for my own clothes starting when I was eight so you bet I needed it. Plus our system paid ten percent interest per quarter. You sure can’t beat that! I had enough saved up (because of our 10-20-70 principle we adhered to strictly…all about that back here) to write up a big check from my account in the family bank to pay for my first year at Boston University.

When I became a mother I wanted to teach our kids money from the start. I just didn’t think I had it in me to do the whole shebang my parents had done. And Dave, who didn’t grow up with our system, had his own ideas. We came up with several more simple methods for kids to deal with money.

Well, as all parents know, as with any parenting idea, these things have to be worked and re-worked.

And then re-worked again.

Depending on ages and stages and understanding and availability of the parents. So that’s what we did: over and over again we re-vamped our money system. Because let’s face it, who doesn’t want their kids to grow up money savvy and UN- “entitled” in a world that could eat you alive if you don’t understand things like credit card debt and the concept of savings?

Some things we did worked great. Others flopped. But finally this year, as our kids have finally reached an age of understanding a little bit better, we were ready:

We adopted “The Eyre Money System” in it’s almost entirety (the simplified entirety…no half points and taking off points here and there, just the stream-lined basics that evolved from that video).

And we’re finally in a stage where it works. REALLY works.

This is what we do with our few little tweaks:

A Family Money System that Works

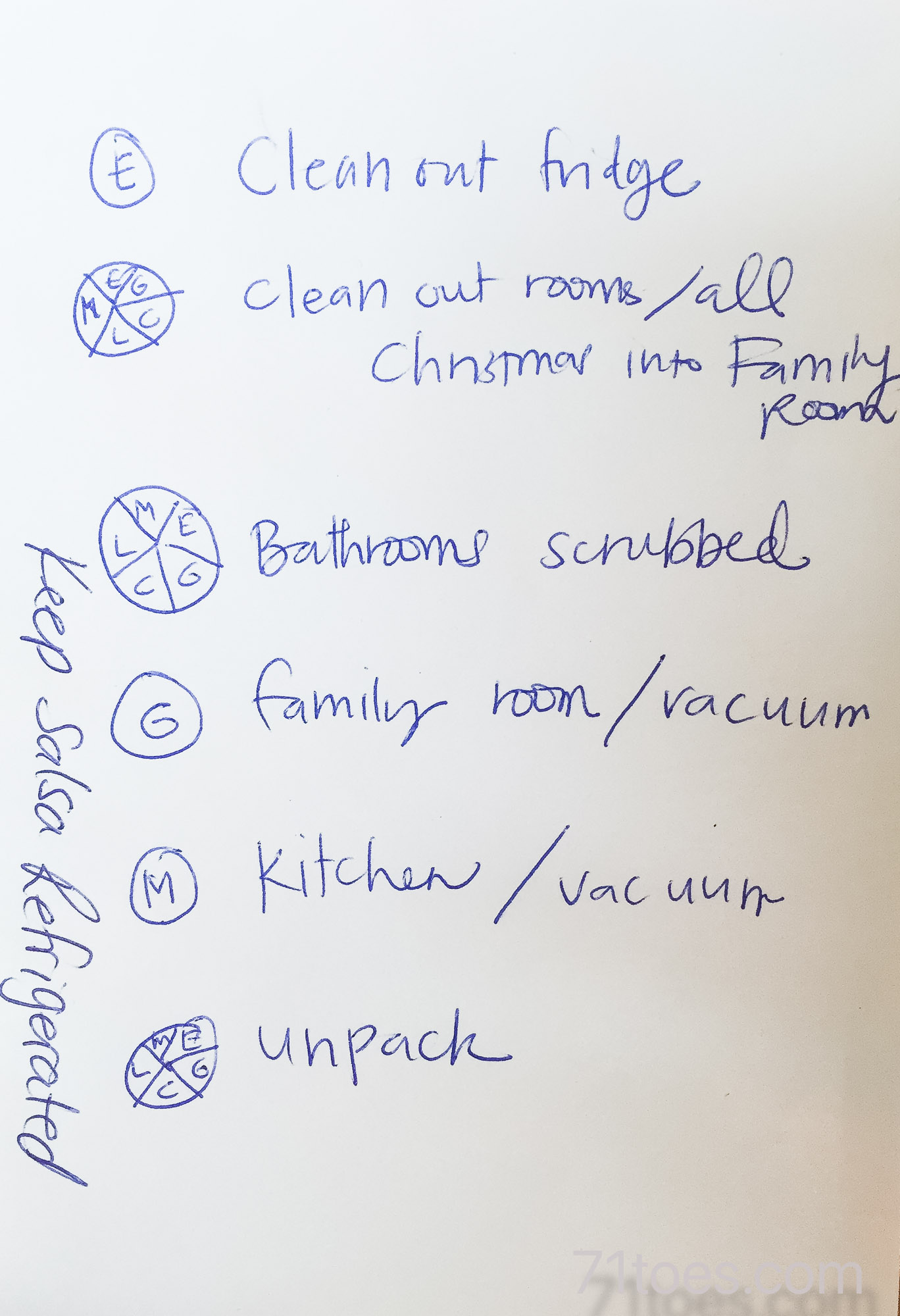

Each week I tape these little puppies up for the kids to check off on a daily basis:

Yeah, as you can see, it’s taken certain kids a little longer to get going on this than others, but three of them are full-fledged into it now every week.

We have a little work to go on the others…

There are just four things they have to do each day, but some are inclusive of more than one task.

1) “Morning Stuff” includes all the stuff they do before school: make bed, tidy up room, do breakfast jobs, come to the family room for family scriptures on time (6:30).

2) “Practice” is just their practice on the piano (we are wimpy and only practice 20 minutes per day right now…), and Grace and Claire have to practice their math flashcards 3x each.

3) “Zone” is from our zone chart I wrote about back here.

4) “Reading” is that they must read by themselves outside of school for a half hour every day.

When they complete their four things for the day, they get Dave or I to sign off on them.

Each week the kids have the potential to earn their age in cash from these nifty charts. That means Max, being fifteen, has the potential to make 15 bucks. Which is good money as far as I’m concerned. He has to pay for half of all of his own clothes though so he really does need it. (The kids have to pay for half of everything when they turn twelve…except for underwear, socks and Sunday clothes cause research shows they won’t buy that stuff….our research….the kind that errs on the side that will ensure they have something decent on Sundays and that they don’t blow people away with stinky-ness.)

On Sunday afternoons we have “pay-day.” (Growing up we did this on Saturdays, but we can’t, for the life of us, fit that in.)

We pull out the good old family bank I inherited from my family and get to work.

Dave is actually the real “banker.” I love that.

And really let’s be honest, who wouldn’t want that handsome guy for a banker??

If they miss even one check-mark during the week, they only get half of their age for that week. And if they miss more than two, they get zero. We’re kinda serious business around here. But we do let them memorize one poem a week to make up for one missed mark if they need it (that’s my FAVORITE part…more on how much I love having them memorize poetry soon…).

Here’s Elle memorizing a poem so she can make up for a missed mark:

Let’s give that little golden box a little shout-out: Don’t you love how that opens? (The key for the lock was lost long ago.)

Don’t you love how that opens? (The key for the lock was lost long ago.)

My Dad carved that sucker for us as kids all those years ago. It says “The First National Bank of Eyrealm.” (Much more about that bank over here.)

I love it.

Let’s take a look inside:

We pay the kids their cash from here each week. (And for some reason Dave got a few two-dollar-bills last time he was at the bank which Grace only realized recently are actually real money…)

As I’ve talked about a bunch before, we are huge proponents of the 10-20-70 principle (here) and we adhere to it with a vengeance. As soon as we determine how much each child has earned for the week they calculate out how much of that they owe for savings and tithing. They put their 10% tithing tucked away in an envelope in a drawer in their bedrooms until they bring it to church. They put their 20% savings back in the bank and it’s safe in there ‘til they need it for something big like college or missions some day.

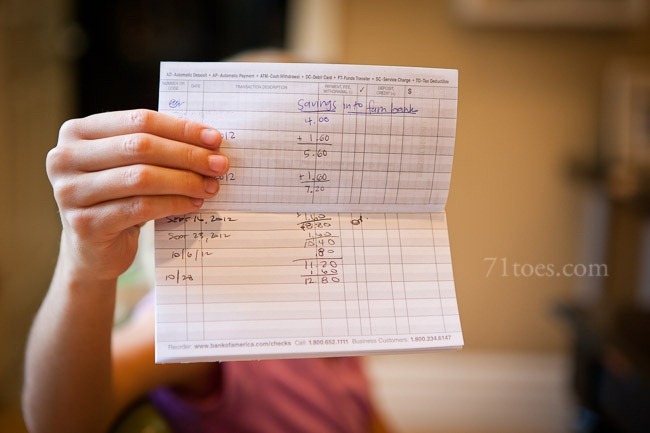

We keep track of savings for each child in a check register like this:

They totally help so they can have ownership of the whole deal…and it’s great for their math skills as well.

Although Max does these charts (with as much enthusiasm as you can imagine a 15-year-old boy would) he’s kind of on a different system because he has his own real bank account. (More about that near the end of this Q & A.) When he gets paid for this money system, instead of having his own check register in our family bank, he makes a deposit at the bank. He automatically transfers 20% to his own savings account there and takes out 10% for tithing. He is still eligible for the high family interest in his savings account cause we want to help it grow for him. We’ll start Elle on that system soon.

I know there are tons of things I haven’t answered. I have a bunch of money questions stored up in my “blog questions” email box that I’ll try to get to along with any new questions on Friday. But for now I want to link to a “work and money” program my amazingly talented sister just put up on Power of Moms. It is really cool because it walks you through each step of the original Eyre family money system along with a bunch of other ideas and has worksheets and stuff to help people make a system that works uniquely for your own family. The link for more info. on that is here.

So, after all that effort trying to re-invent the wheel, here we are back at the beginning.

And boy am I grateful for this system that works.

Sure, we have tons more tweaks to go, and it is certainly not fool-proof by any means, but we’ve been going strong for a few months now and I’m loving it. I love that it has all the potential to really help our kids understand more about money in the long run…and savings. And giving. And work.

Thanks, Mom and Dad, for being so deliberate about all that stuff when you were raising us.

P.S. Oh man I don’t want to get political but I’m just gonna say, REMEMBER TO VOTE!!!

(Lot’s of answers to the questions that came in the comments to this post over here and also here.)

I was just reading about this on your parent's site. Last night, in fact. Glad that you posted this today. It's a great reminder (and insight!). Thanks, Shawni!

I love it all! So smart! Just one thing….did the link to the worksheets and money/work system that you mentioned get left out? I clicked on the word "here" but there's no link:)

Oh my gosh thank you so much for doing this post! I've read so many of your parents books and am still reading them and I still do best with visuals as I'm a visual learner! So one question. Do you keep an envelope or something inside for each kid for their savings? For me I'd actually have to put the money away that they are saving so that when they cash out at 18 I don't have to scramble to find the money. How do you handle that aspect? Do you have bank accounts for them? I'm sooo curious of all the little tiny details. Oh and yes the link to Power of Moms isn't working. So excited you did this. Thank you!

dg darling, the link is in there now 🙂

Visible Voice, since we are the "bankers" of the family bank, Dave and I will always make sure we have the funds available for them (in our own bank accounts) whenever they want to withdraw them, but they are not allowed to take that money out until after they graduate from high school. We won't actually store all their savings in there since, as you can see, that bank is not exactly secure:) It's just the principle of saving up for something really important and i hope we can instill that firmly into their minds. They know those savings totals written in those check registers are their own money, and sometimes they don't like the fact that they can't use it right now, but they'll thank us in the long run for helping them save. (I know I sure thanked my parents for that!)

Max does have his own bank account. I should probably add that into this post. Every time he deposits money in the bank he automatically takes out part for tithing and transfers 20% over to his own savings account. We'll start this up with Elle when she turns 15 (I think).

Any suggestions for those on a limited income? Our kids are 12, 10, 8, and 6 and so $36 per week is quite a lot for us. I think I would be excited for them to NOT do their jobs 😉 Any readers have an amount these use that still gives their kids an incentive but doesn't break our bank?

Sorry. One more question…what age did your children start taking piano lesson?

When you say they have to pay 1/2 of everything does that include sports/lessons? I know it includes clothes, what else does it include?

I LOVE this idea – making up my checklists today! My questions are:

When do you pay the interest? Each "payday"?

Are there other chores the kids are responsible for which they don't get paid? Just "you're part of the family, so you have to pitch in" chores?

We have adopted your parents system, for the most part. I have a question about tithing though. So the kids pay tithing on the amount you give them, but have you already paid tithing on that money? Do you not pay tithing on the portion of money you pay them? Is the money "double tithed"?

Brilliant ideas:).

I've always wondered what the Eyre family bank looked like & now I know.

I love how you have lists where they have to tick off morning chores etc.

Have you ever done "pegs" in your family? I remember your Mum & Dad saying that their favourite question in the house " Are your pegs in?"

I really wish British children were taught responsibility like American children are.

What do you do if your children lose something, such as a lunch box at school, do you make them pay for it?

Tamara, that's an interesting question about tithing.

Rick and I were just saying we needed to revamp our family finance system. Do your kids have to come clothes shopping with you then, to spend their own money?

Love the visual too! I needed to SEE it to understand the system. Gonna try it out!

Ever since I read about the system in your parents book I've wanted to do it, but it seemed like so much work to get it started and find a bank to use and I haven't found the time yet. So thanks for this post. I realize I need to just start and do what I can. And I like the charts- easier than pegs to do right now.

What a great idea this is, thanks for all the helpful info and pictures.

Like one of the commenters, what do you suggest for a fixed income family?

We give our kids $5 every two weeks when my hubby gets paid. On rare occassions they get a little extra for weeding the garden, extra housecleaning.

I know it's not much to work with but it's all we can afford.

My mom had a system when we were 16and had a job. We had a regular envelope for car payment and car insurance and we divded our paychecks each week to save a portion for each of these bills. That is all we did and the rest was ours to play with.

My kids are 15, 14, 11. The oldest is hoping to get a job at Mcdonald's when she's 16 to fianlly be getting some "REAL MONEY" as she calls it. We already told her it will go to her first car and helping to pay insurance and gas.

Thanks for this post and your Q/A one coming on Friday. These are so inspiring to read.

Ok, my oldest turns 8 next year and I find myself thinking a LOT about the money system we need to have ready and in place for when she turns the money-making age. So I have a couple questions 🙂 How did it work for you when your oldest was the only one old enough to earn money? Was that child the only one with a chart, or did everyone still have a chart but the younger ones didn't earn money yet? Also, you mention you've tried a lot of things that didn't work or needed tweaking … what didn't work for you and why? 🙂 THANKS!

Thank you…I want to use this money system & the zone chart. Great ideas!

20 I saw you included Lucy on the jobs as well. How do you handle paying her when she will probably miss 1 or 2 very easliy at such a young age. My children are 7, 4 and a newborn. I love the system but know it will lead to no money for my little guy at age 4.

I love that your dad made a video of himself presenting the new money plan. That is so funny. Sounds like a great plan. I wish I had been in the habit of saving 20% of my income back in high school! (Or earlier!)

whoa, that's a cool money system! my husband and i were just talking a few weeks ago about how we wanted to do something but didn't know where to start. thanks!

Hi Shawni, Thank you for your nice blogpost about money. When our kids were smaller they each had a star chart and earned 5ct per stamp or star. If they misbehaved or didn´t do their chore they received a black star that would cost them 2 stars. So at the end of the week they counted their stars and had a bit of pocket money. We should re-introduce this again. Thank you for sharing your money system and chart. And I enjoy reading your blog. Greetings from Moz.

http://www.casa-amarela-ideias.blogspot.com

We have used almost exactly your parents system since our (almost 20 year old) was 8 and we love it.

We use the 10-40-50 principle and require our kids to save 40% of everything they earn for future missions or college. We feel like over saving now will make saving a smaller amount of their "grown up" incomes seem easy 🙂

Janelle – We only give our kids $5 for a whole week of filling in their charts (I buy their clothes). We also then offer other earning opportunities – extra jobs around the house, school achievements, memorizing quotes or scriptures. I don't think the amount matters as much as the principle that you are teaching them to earn, save and budget.

Tamara – I prefer to personally err on the side of over paying tithing rather than accidentally short change the Lord. You can think of it the same way as if you have a cleaning lady, or pay someone to mow your lawn. You are paying them out of your discretionary income. What they then do with their earnings is their choice, and as parents we want to teach them to pay their tithing.

Thanks so much for responding Shawni! I love this concept. I just made a chart for my son that I'm going to put in a picture frame and he can use a dry erase marker over and over! (It looks pretty awesome I should say! Hee hee)

I'm still trying to figure out how to explain it all to him. Savings, tithing and spending and why. I think I first need him to do the charts and see the payment happen and then teach him about how life is and get him to start saving. Probably will tell him that at his first pay day that he will soon learn how to do the concept. And since we never have cash in the house I'm thinking I best cash some out and keep somewhere for him to actually get paid!

Thanks again!!!

Terrific Shawni! We just gave a talk on this tonight in Orange County and sent them to your blog and powerofmoms.com before we even knew that you had posted this at just the right moment. Perfect! Congrats on the terrific tweeks!

How fun is this to see? GREAT JOB!

shawni, thank you for taking the time to post about this! i too, incorporated a payment system for chores about 4 months ago. i based most of it off of dave ramsey's method which includes tithing. we are also very passionate about tithing…no matter what! anyways, i'm needing to tweak things so this is perfect timing…i'll be researching your posts and ideas. thanks! and as always, you and your family are beautiful! 🙂

I love this idea. However, I have a 3 year old and a 1 year old. For the life of me I can't get both of them to do anything not even pick up toys. I don't know if they'd understand charts. Does anyone have suggestions?

Instead of printing a paper every time, you can get one of those cheap certificate frames and use a dry erase marker to mark them off. We have a very similar system when we do do it. But we pay our oldest (8) 25 cents a chore and our younger two (5 & 4) get 10 cents a chore (we are on a tight budget). They also have other chores they need to do that they don't get paid for. They each have a college savings (which is 20%) and they pay tithing (10%). And then we have a family mission fund that they can put what ever they want in and anyone can use that money. That way everyone feels like they have helped that person go on a mission and he/she becomes a family missionary. And we have a family vacation fund that they can put what ever they want in (both of those fund come out of what is left from the 10 and 20) My younger two I pay immediately when they do something so they get that instant gratification and then at the end of the week instead of concentrating on percentages they just put what ever. We'll work on percentages later.

I do love the memorizing poem thing to make up for a day. I would probably extend it to a group of scriptures too.

What a great post, thank you so much! We work on a system of making money doing "jobs" (not chores, because we don't get paid for doing work as part of a family), and we are so proud of how our four year old already loves to save his money to buy things that are important to him.

Kricket Arends – We have had great luck with Love and Logic for questions like not picking up toys. Seriously takes almost all the stress away for us. They have a website with free articles and podcasts and great books and CDs (some of which can probably be found at your local library).

Thank you for this. I grew up in a house where we had to pay for our own things too. It was hard sometimes when my friends would get allowance for being alive, plus their parents bought all their clothes, etc. and I had to pay for my own things (we paid 25% in elementary, 50% in middle school and 75% in high school). We did jobs to earn money but also just because when you live in a house and are part of a family you should do your part just because and not for money. I have young kids and have just recently been trying to figure this all our for our family. This really is very helpful. Thank you!

I love your blog!!! I often quote you as the best mother I "know"!! We do charts too, and used to print beech week lie yours. We now have one in frame with glass hanging on the wall and the kids use a dry erase maker to check off chores. A bit greener and looks really nice! Thought you may like the suggestion!!!

Fantastic post, Shawni! Thanks for getting down to the nitty gritty to make the system approachable (it takes A LOT of research, work, and disciplined consistency as a parent to implement any kind of successful monetary system for kids). You never cease to amaze me with your thoughtfulness as a mother–I'm just grateful your children are older than mine so I can learn the ropes from you ahead of time!

This is a great system and just the kind of thing that I wanted to do with my kids- but wasn't sure how to get started. You motivated me! We are a week into it and I have a couple questions that have come up over the week- for maybe a Q and A post or something…

Some of my kids LOVE this kind of thing and are totally motivated by it and slipped right into the routine… while others, not so much. I have to say, it's been hard! Is it normal to have a little bit of a rocky road the first couple weeks? Do you keep reminding them or do they do it completely on their own? The children aren't sure how to do their jobs, need help with them, lots of reminding, etc. I feel like maybe this is to be expected, as we all kind of settle into a new routine. Did you experience this?

My other question is about my 6 year old, she reminds me a little bit of your Lucy. She is having a harder time with the whole thing. Yesterday she said, "I choose not to do my zone tonight." What do you do in that situation? What if the money at the end of the week isn't motivating to them? Also, do you let them make that missing check mark up? I kind of feel like the missing check marks should not be allowed to be made up when it's a conscious decision to not do the work.

I so appreciate your great ideas and any help you can give me! I am inspired by you and how you mother. Thanks!!

dne29@hotmail.com

Totally awesome!!!! Thank you so much for sharing. God bless you.

I found this post via Pinterest a few weeks ago and knew it would be a good fit for my 5 kids. We've used it for a month now and it has made a HUGE difference in our family! Thank you so much for sharing it!

Love this thanks so much for sharing!!! We started it last week and worked great! I have a question though. My son who is 5 saw that my daughter who is 9 gets more money then him and thought that wasn't fair. At first I thought well she's older but when I realized the job charts they are doing pretty much the same thing. How do you justify paying more to older siblings? Do you have them do extra stuff thats just not listed? Thanks!!!

This is very similar to what we came up with for our girls. They don't get to earn that much yet, but they are only 4 and 5. As they get older and can take more responsibility for doing things the amount will increase. Glad to know we seem to be on track!

Love this idea! I am trying this with my girls. What a great way to build responsibility. 🙂

Where is the link for the charts you use???

I USED THIS SYSTEM FROM YOUR PARENTS BOOK in the early 90's,FOR MY 2 GIRLS NOW AGES 28 AND 30 TODAY, THEY STILL TALK ABOUT IT, THEY LOVED HAVING THEIR OWN CHECKBOOKS! The eldest daughter is a financial guru and swears it's because of what she learned from this system. Saw you on pinterest and had to take a peek, thanks for bringing back a great memory!

Can you send me the link to the chart? Also, what is the name of your parents' book that explains all of this? Thanks!!

Great post! I stumbled up on this on Pinterest and love so many of the ideas here, however I must disagree a little bit and say that I think kids should have certain expectations of pulling their own weight around the house that they aren't paid for. We do a system much like this but they are only compensated for extra jobs. The rest is just their responsibility because they are a part of our family and get to live in our house and eat the food that is brought to the table for them. So many little great ideas here though to use, thanks for the post!

This is exactly the type of system I have been looking for! Thanks for sharing. I am planning our family meeting to bring this into action.

This is the first time I have read your blog, and I feel a little silly asking this since you probably have never been in this situation but here goes! My husband and I are struggling financially, partly due to neither of us having the money system taught to us, and partly due to some bad decisions on our part early in our marriage. We have 5 children and have went through the Dave Ramsey program (a lot too late!) and have tried to stick to, which is a lot like your 10-20-70 system. Our oldest child is 15 and I would really like to do your system, but we can barely make ends meet as it is. So my question is, how could we teach these very important lessons on money without giving money? I don't want our kids to make the same mistake we did, and I definitely want them to be more responsible with money than we were.

Wisconsin used to have meaningful consumer protections and a vibrant financial sector fifteen minute payday loans with countless locally owned lending institutions. Now we have legalized loan sharking and financial institutions mostly controlled by out-of-state interests.

I mean, there is so much new technology there’s got to be a better way to do a lot of things, right? And then when it comes to parenting, there are new whiz-bang ideas everywhere you look. GS Loans

All kids love to play with toys.Because of being a soft plush toy, kids can throw this Angry Birds Plush Pig at each other without danger of anyone getting hurt.and serves as a good companion to your child. This fantastic plush toy

is simply adored by anyone who is an Angry Birds fan.

More about this you can click here.http://liztoys.com

Love this and just got my chart done! The only difference is I added, in a smaller font, what the jobs are under "morning" make bed, tidy room, breakfast job, "practice" piano 20 minutes, "zone" see zone chart, "homework" school subjects, reading 30 minutes and I added a column "bonus" R.A.K. (Random act of kindness)

Thanks so much, I have been trying to come up with a simple method and I think this is it! 6 kids 13 years-almost 1, I need simple right now. I read so much of your blog last night and got so many ideas. Thank you again! 🙂

This sounds like such a great idea. Hoping to start it up in our family. Just wondering a year into it if you have any changes or additional suggestions? Is it still working its wonders? Thanks for your ideas.

This came to me at a perfect time! I had your parents book as soon as it came out and read it while in Italy and shared it with anyone who would listen. We implemented their methods and loved the results. Then we moved to the Middle East where we have a wonderful friend and housemaid who comes three times a week and we have become total slackers!! I've been trying to figure out what to do and I always first go to the Lord then to Pinterest :), that's where I came across this post. Thank You!

Great article! Thank you for sharing.

I am looking for suggestions on dealing with monetary gifts? Say a child gets $100 for a birthday gift….what is the best way to process that throughout the family bank?

I'd say monetary gifts is like getting a paycheck or lottery; they pay a tax on it that goes into the "bank"…? Seems fair, like we're not taking THEIR money, not all of it, anyway… and it is a reality adults have to deal with….

I am ALL over this! I wish I'd found it sooner! What a perfect way to teach kids about money management. When I was young, all I was told was "Don't buy something unless you have cash for it". Well, a credit card was money in the bank, right? NOT. I learned the hard way and am still repairing my credit. If the schools aren't going to teach the banking and credit systems, it's our job as parents to fill in those blanks, from the safety of home.

I am curious to hear any response to Jeri Thompson's comment… if they get a monetary gift, it's theirs, but for an "economy" system to work, they should just pay a tax on it, right? Then utilize the rest in the 10-20-70 format? Hmm…

My boys are 11 and soon to be 5.. their age difference makes it hard to balance chores (the 11 year old always has much more to do than what my 4 year old can physically accomplish himself). Point being, I need to find a healthy way to implement this system with my younger child, even though it's recommended to start at age 8.. that's currently the only thing that has me a bit stumped… His basic "chores" aren't really chores, but taking care of himself without help or supervision….

In any case, I'm excited to tell my hubby about this and get started designing our own similar system. Thanks again for sharing! 🙂

I have been using your money system for about a year now and love it! I have needed to tweak it a little because of the dynamics of our family. I was wondering if you could give me some personal advice. We have 6 boys who are very crazy to say the least. Oldest is 17 down to a 4 year old. They fight constantly and procrastinate everything. They struggle with getting homework done, brushing teeth, making their lunches, helping with dinner, and going to bed. Would you think it is overwhelming to add all of these to the chart?

This system works out really well in my opinion.

I constructed a little chart that shows how much money is earned between ages 8 and 18 if a child is paid their age in dollars every week, they save 20% of that amount every week, and their savings accrues 10% interest every quarter.

If the child is perfect and they are paid a full amount each week (we wish, right?), this is how much they will accumulate:

Starting at age 8: $0

By age 9: $106

By age 10: $275

By age 11: $535

By age 12: $929

By age 13: $1519

By age 14: $2396

By age 15: $3694

By age 16: $5608

By age 17: $8423

By age 18: $12,558

That could just about cover all of their college tuition if they attended community college, then transferred to a cheaper 4-year university.

Or it could pay for a 2-year mission 🙂

What happens on weekends? Do the parents take over the chores? Do kids still do them, but not track or earn credit for them?

Great question. We have serious Saturday jobs that no one gets paid for…just something we need to do before the kids can hang with friends. Those are outlined over here: https://71toes.com/2015/09/saturday-jobs-that-work.html

Tell me, how exactly do you use cryptocurrencies for this? My son is already 14 and he earns cryptocurrency himself using a special farm (we have solar energy). The maximum that I could show him is how to properly use the online exchanger to buy eth with btc. This made him independent enough to manage his money. But he still often consults with me when it comes to major purchases)

Awesome Piece of Writing

Best Hotels to Stay in Switzerland

Hi, would love to see the pictures you reference here but for some reason they aren’t appearing or working on my various browsers. Any chance you could resend me another link of the referenced pictures to get a full idea of what you’re describing? Thanks and love the concept!