I was talking with Abby on the phone the other day and she was laughing about how into budgeting Max is lately.

And I had to laugh myself, because that little snippet of good-budgeting created a flood or memories back to “little” Max who could not hold a dime in his pocket to save his very soul.

Money burned it’s way right through his pockets. Even at the beginning of college Dave and I would shake our heads wondering how in the world could we help this “spender” of ours??

I’m here to tell you that it’s fun to watch things click in older kids after you have worked your heart out trying to teach them when they were young (sometimes those things don’t actually click until they marry an awesome person to partner with to make it all work…love you Abby!)

Anyway, I bring this up because on the “In the Arena” podcast LAST week (I’m getting behind on my little overviews here on the blog!) my sisters and I mused over how we were raised with our whiz-bang Eyre money system.

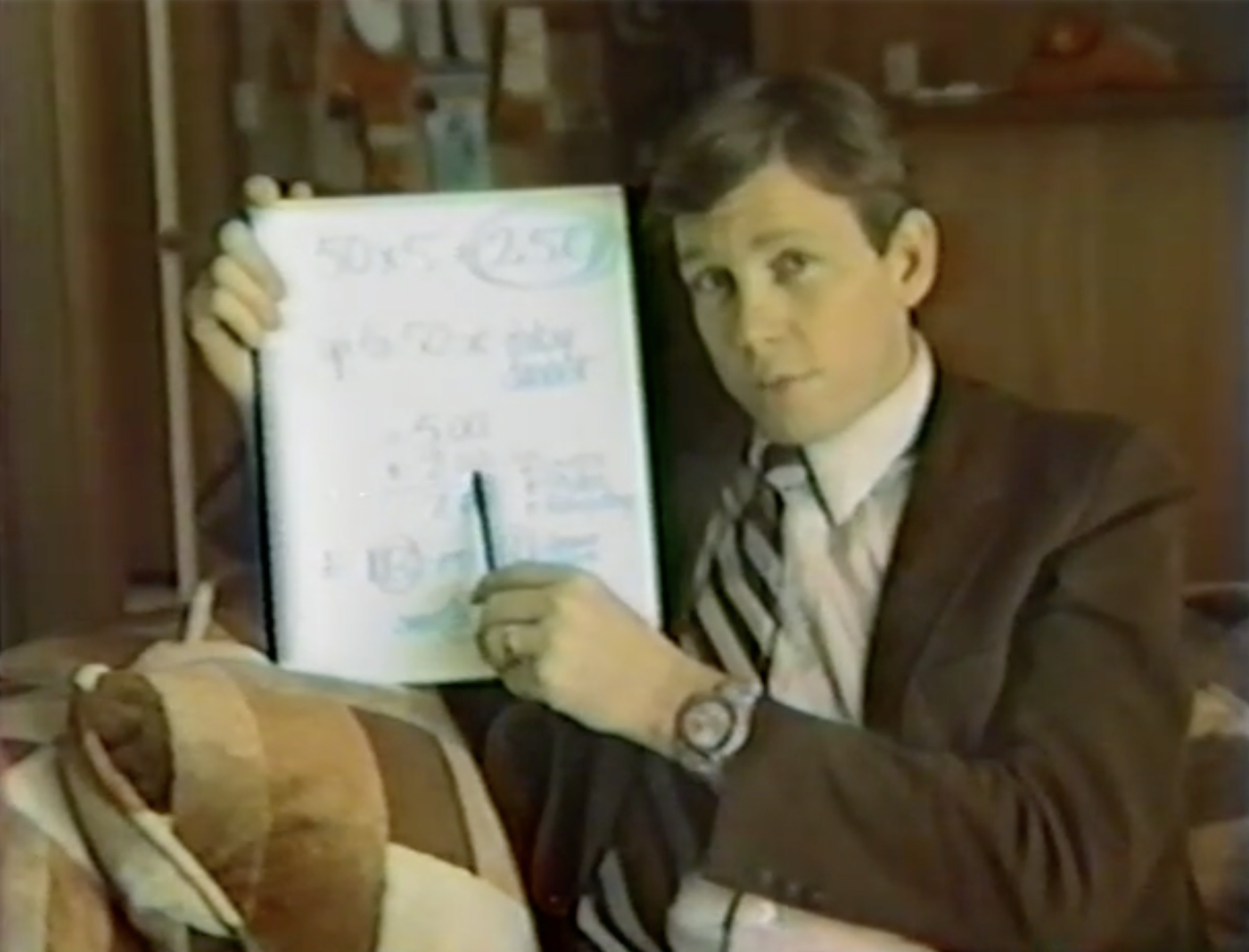

We talk about the elaborate system our parents came up with and let listeners hear part of an endearing video our Dad made all those years ago to teach us all the tedious details.

I love that video for two reasons:

- What an awesome parenting tactic to get us to really listen (making a video of yourself talking…maybe it wouldn’t have quite the same reaction now in a world filled up with screens… And what care our parents put into how to teach us.

- It made me realize (again) that sometimes a “first draft” isn’t what ends up working. Sometimes we have to revamp and renew over and over and over again to find something that works. And I love that even my parents who I look up to so much started off with something way overly complicated, and lived to tell the story of reworking to make it work in our family.

We talk about this special family bank:

And how it gave good interest to help incentive savings.

My sisters and I each talk about how we have revamped that system and used parts of it in our own families.

So many “pay days” over the years!

The bottom line is, what a gift we give to our children when we create an opportunity to learn how money works.

How to help kids earn it.

How to help them save it.

How to help them be generous with it.

And how to help them learn to spend it wisely.

(We talk about my favorite 10-20-70 principle that I love so much, and how it has helped us all in our lives…and I love watching my newly married kids adopt it so beautifully into their own budgeting. That principle is magical I tell you!)

It’s going to be different in every family, both parents coming from different backgrounds, different concepts and needs and wants.

But the point is to talk about it.

And to have a plan (even if it’s a meandering one like my parent’s was for a little while!)

Go take a listen HERE, and we’d sure LOVE to have any insight or ideas of how you do it in YOUR family over on Instagram HERE.

Family Money System Ideas

Our Family Bank

Keeping track of Savings and Giving

Deliberate Parenting at it’s Finest

(This is the one with the video my Dad made to explain our complicated “first version” of our family money system.)

This was a very interesting podcast. I’m curious, you talk so much about teaching your kids how to work with money , how to save, invest etc but you also give them a free education, free trips around the world ( I apologize if I am wrong in presuming that, but I can’t see how university students can travel around the world and country so much if they are funding it themselves ) so my thought is, really how much are you actually teaching them about real life?

Oh there’s so much more to “real life” than an occasional trip and college!

And that’s the entitlement trap!!!!!

Occasional ?? LOL…

Teaching them that when they get to a certain age or grade, they will be ENTITLED to a trip somewhere to “intern” LOL. Also teaching them that they only have to base their decisions on college, career, etc. on what they WANT (or what sport they want to play), because it will be taken care of. Teaching the girls that they should get a college education, then have lots of babies while their husbands pursue a lucrative career – also parent-funded.

So yeah, not a lot of real world stuff….

There are a bunch of different ways for people to live their lives. Shawni’s life IS real world, as it is the real world for her and her family. It just may look different than your reality. If Shawni’s way of living does not resonate with you, then just choose to not read her blog or listen to her podcast. I will never understand feeling the need to be judgmental when you can simply choose what you read, do, etc. Spend your time doing something that brings you joy, and if this blog isn’t it, find one that does! Personally, I am very thankful for this blog. I have taken concepts Shawni has introduced and made them work for my family, and it has brought a lot of joy to our lives, which is why I’m here.

You took the words right out of my mouth! A friend recently commented to my husband that he couldn’t afford the gym we belong to (first time gym people here, and we’re using it to it’s fullest after a doctor visit prompted us to better our health). I’m pretty sure they earn about the same income as we do. This same friend’s wife looked shocked when I told her I shop mostly second hand. I know she loves to shop, like I do, but we shop differently. People spend money on what’s most important to them. Some people have more money, some have less. Basic financial principles still apply.

If they are capable of college they will be fine. Some people make 100K and have no savings. Some make 80K and have 50K savings at the age of 28. It is not how much you save but how much you keep. The 10-20-70 isn’t a bad idea. The point isn’t really the 10-20-70 just save something and give something every month or check. There is a feeling of wealth when you manage to save something and give something in a month. If they didn’t get the free vacation to Europe they just would not go at age 28. The senior Eyre’s had money and a lot of kids over 16 years. I’m sure they were scared how they would disperse money fairly. Saren’s school most likely cost less than Charity’s. So they wrote books to make kids jump over hoops to get something. The irrational interest they paid on kid savings, grants to do an activity among the younger grandkids in order for them to learn to present a plan. The fund is just money they kept separate. A separate envelope of the Dave Ramsey system. She could have just put it in the pot and spent it but didn’t. The books and speaking are pitched for all but really just favor the wealthy not wanting a bunch of kids asking all the time for stuff or money. Don’t spend everything. The 10%-20%-70% system does not really make sense off the bat. Start will smaller amounts and then with the next raise increase the saving or giving category just a little. When the senior eyres came up with this they didn’t have some expenses required of people today. They were in England if I’m not mistaken. College increased greater than inflation. You could work part time and manage the tuition. Can’t do that today. The universities have gotten greedy. In the US students often take jobs in high school and college, real 20 hour a week working for strangers type jobs. Because of that they gradually start taking on some expenses of their own like car insurance and cell phone. So when they are out on their own they are just adding some extra bills. A lot of states are requiring a personal finance class one semester in order to graduate high school. People will have self control or not. And some will just have rotten luck with mortgage interest rates and housing supply and others have great luck. Poor people can’t make mistakes. Rich can make mistakes. They kinda have to be home to do Saturday jobs to get paid for doing Saturday jobs. Are they home 4 Saturdays in a row at any point in the year?

I’d love to see an experiment if you didn’t contribute a dime to anything for 1year for your adult children to see how they would cope & navigate their lives. I think it might be eye opening for all of you.

Yes, and also 1 year of Richard and Linda NOT use her “fund” for the sister’s trips, siblings trips, future mothers trips, chill out in Bali trips…. and make them stay in hotels instead of one of their condos, beach houses, country homes, etc. when they travel.

Some siblings (Shawni) could afford it… some siblings could not. They would have to be INDEPENDENT. Or drive their taco grease car…..

That’s a very interesting system, Shawni. Of course every family will work it according to their needs and realities, as you said. But I love that you share the idea of introducing money management to kids. I think it’s definitely something that can be adaptable to different backgrounds and that’s what’s good about it.